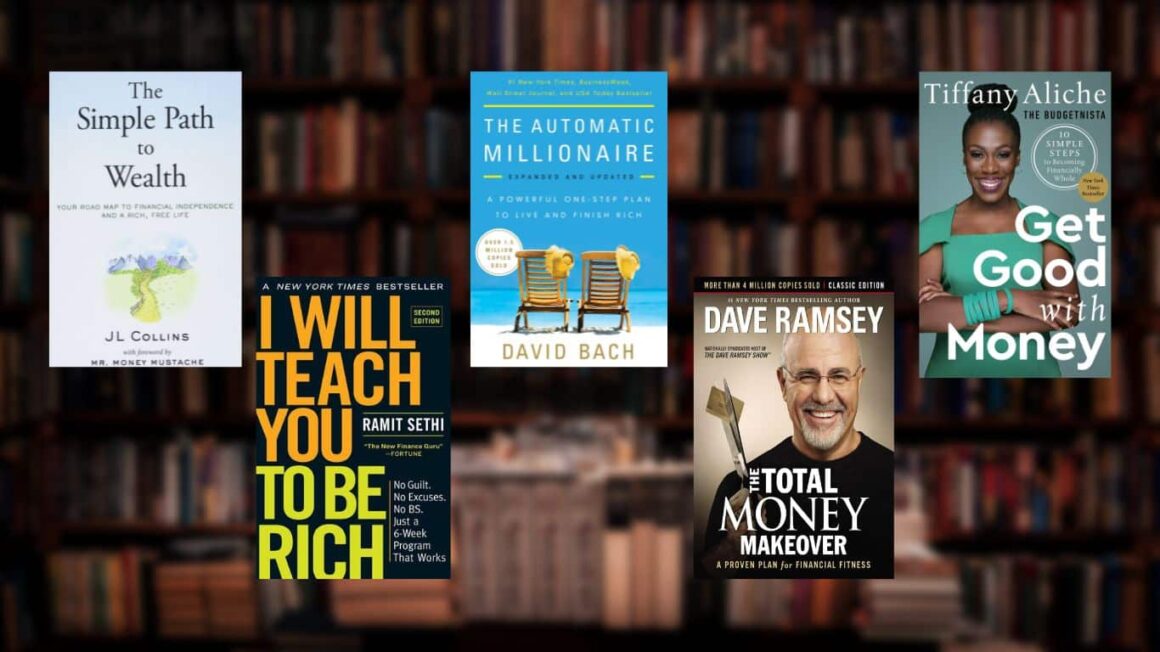

With the help of a book, you can literally find out and learn about anything you want. If you are new to investment or financial things, picking up a god finance book would be a smart choice to start with There are several self-help and guidance books on finance. Here is a list of 5 finance books for beginners, so that you don’t have to choose from hundreds.

5 Finance Books for Beginners

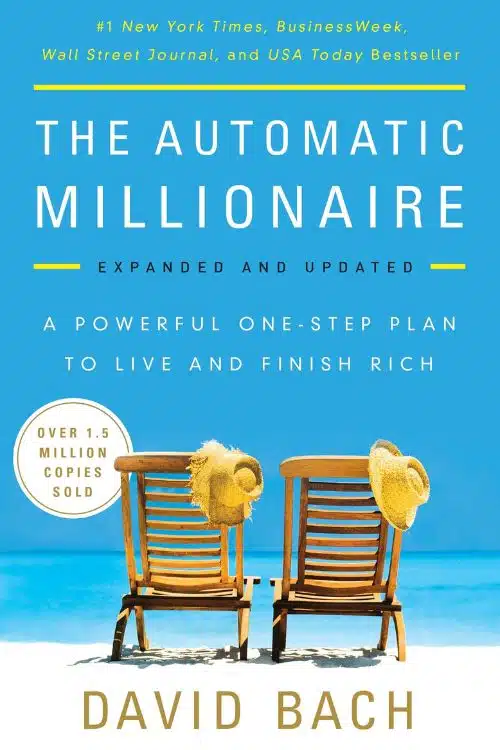

The Automatic Millionaire, Expanded and Updated by David Bach

The Automatic Millionaire prefaces with the powerful story of an average American couple. She is a beautician and he is a low-level manager. Their collective bank account never seems to surpass $55,000 a year. However, they can still manage to buy homes, put two of their kids to college, and more. Through this book you will understand that a budget does nothing, you have to come up with a plan that works for the future. This book says you don’t need a budget, willpower, making a lot of money, setting up the plan in an hour, and more.

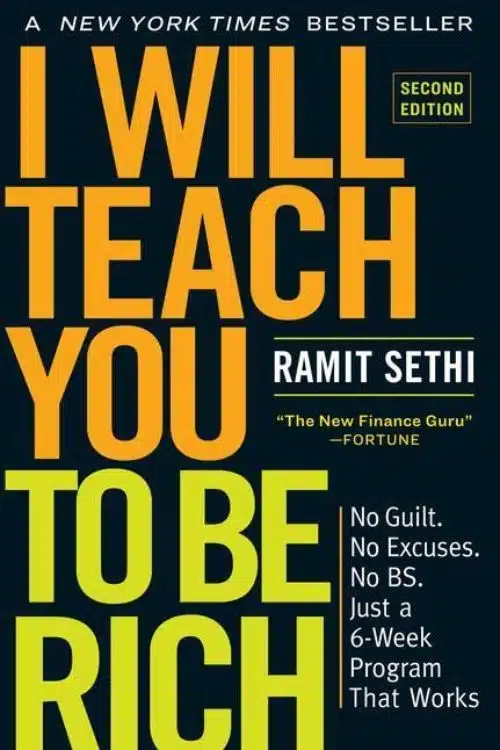

I Will Teach You to Be Rich by Ramit Sethi

Forbes has called personal financial expert Ramit Sethi a “wealth wizard”. Fortune referred to him as the “new guru on the block”. I Will Teach You to be Rich will help you learn a few things – set up no fees high interest bank accounts? How Ramit automates his finances so his money goes exactly where he wants it to and how you as a reader can do it too? Big expenses such as having kids, buying a car, and a house, and how you can take care of them without any stress.

The Simple Path to Wealth by J L Collins

Money is the power that navigates the world so it is significant to understand it. J L Collins will help you out with all the confusion you have regarding money. In The Simple Path, he explores several financial aspects such as – why we must avoid debt and what measures to take if we have it. Which investing advice actually works? How to think about wealth and money? What is stock market and how it works? Why people lose money all the time even if the stock market goes up? What is financial independence and how to achieve it? Why dollar cost averaging is not recommended?

The Total Money Makeover by Dave Ramsey

Personal finance is certainly not an ecstatic topic to discuss. It is more so true when the takeaway message is to practice restraint and behave responsibly. None of us wants to know that we are all responsible for our poor financial calculations. Dave Ramsay’s idea is to kill today and get richer tomorrow. Do not spend the money you don’t have. Save money for future expenses. One of the Stories is their own story of bankruptcy and how he got ways with it. This book will hit you in the gut and make your head shake

Get Good with Money by Tiffany Aliche

Tiffany Aliche was a successful preschool teacher. Sadly, a collapse and advice from a shady person put her out of their job and into the pool of financial crisis. However, as she began to chart the route to rescue her from this pool, the outline of her ten-step formula began to form a shape. These ten steps have now saved a million women to save and pay off debt, and preface planning for an affluent life. Get Good with Money introduces the concept of building wealth through an achievable and realistic financial wholeness. Another important aspect of it is to alternate the complicated management system. This book talks about how to systemize your expense, make a plan, and an assessment to learn about issues, money investment, credit score, and more.

Also Read: 7 Books on Small Changes that Drive Large Results