Things That Are Stopping You From Becoming Rich: For the majority of individuals, becoming wealthy is a dream, but with careful preparation and perseverance, it can become a reality. A six, seven or eight-figure net worth is not something you can achieve with a single formula, but there are several actions you must never take. Here are the most typical errors that will hinder your quest for financial success. which are as follows:

Things That Are Stopping You From Becoming Rich

Failing to stick to a budget

Even millionaires and billionaires require budgets; otherwise, they wouldn’t be wealthy for very long. Budgets are often perceived as restrictions, but the wise among us see them as tools that can hasten the completion of our financial objectives. Budgeting some money for short-term wants is acceptable, but after covering your fundamental needs, your priority should be to start saving for your long-term objectives. Although saving for retirement should be a top priority, you may also want to set aside money for other objectives like buying a new car or house. Choose the monthly amount you want to dedicate to each goal, keeping in mind that the more goals you allocate money to, the longer it will take you to complete each one.

Carrying too much debt

A mortgage, for example, is acceptable debt provided you can easily afford it. However, other loans, such as credit card debt, have no benefits. You incur enormous expenses from high-interest debt, which also stresses you out and jeopardises your financial stability. Make an effort to pay off any high-interest debt you already have so you may begin saving that money each month rather than paying it out to others. To temporarily stop the increase of your credit card debt, think about a balance transfer card, or get a personal loan to pay off the balance so you can make a regular monthly payment. Spend tax refunds and year-end bonuses on debt repayment to accelerate the process. Once you’ve paid off your debt, you shouldn’t take any more, or you’ll find yourself right back where you started.

Not investing

One of the best methods to increase your wealth is by investing, which is also the only way to guarantee that your money will grow faster than the rate of inflation. You should invest your long-term savings if you want to grow wealthy, but it’s not the ideal choice for your emergency fund or short-term funds that you plan to need in the next five years or so. If you wish to have unlimited access to your money, a taxable brokerage account is a preferable option. Although these accounts don’t have the same tax benefits as retirement accounts, if you keep the assets in the account for more than a year, your earnings will be taxed on long-term capital gains rather than ordinary income. You can keep more of your investment earnings since long-term capital gains tax rates are lower than income tax rates for the same level of income.

Investing too conservatively

As you get older, you should switch to more cautious investments because you won’t have as much time to recover from losses before you need to spend the money. But younger investors ought to put more money into equity investments. Some risk-averse investors are scared off by the higher volatility of stocks compared to bonds, but they can also yield significantly higher profits. This is how asset allocation is done. All investments involve some risk, so instead of keeping only safe investments in your portfolio, consider diversifying it. Spread your money out over a variety of assets and industries to prevent your portfolio from being completely destroyed by one under performing asset. As you get older, shift your money to less volatile investments like bonds, but keep some equities. The percentage of your portfolio that should be made up of equities is best calculated by subtracting your age by 110 or 120.

Growing complacent in your professional life

Even if you consistently invest, you’ll probably need a day job for a time. If you take action to improve your situation as opposed to staying put where you are comfortable, your wealth will increase more quickly. When you feel you deserve a raise, don’t be hesitant to ask for it. You can also keep an eye out for organizations in your sector that offer higher compensation. In order to expand your network and strengthen your talents, you should also go to networking functions and professional development seminars. You might be able to get a better job as a result of this.

Get outside your comfort zone

Because they have understood that success comes to those who welcome a little discomfort, wealthy individuals are successful. They are aware that pushing oneself past your comfort zone is the only real way to advance. You must feed your creativity, develop original company concepts, and then take the risk if you want to become wealthy. Success and wealth do not come from the security of a 9 to 5 job. They result from relying on your inner fortitude and pursuing your huge desire. In order to achieve the pinnacle of success, all visionaries, game-changers, and corporate leaders have gone outside their comfort zones. The historical figures have the guts to face their anxieties and take that initial step into the unknown.

Create multiple income flows

Making more money is easier the more money you have. Additionally, having many streams of income is the simplest and fastest approach to increase your revenue. As a result, you will always have cash flowing in and can utilise the extra money to invest in additional income streams. In a word, this is how the wealthy people mostly maintain their wealth. There are two main types of income: active income, where you work to get money, and passive income, where payment is made regardless of how many hours you put in. Rental property, dividend stocks, index funds, producing a book or developing an app are all examples of passive income sources that will generate a consistent stream of revenue through royalties or sales.

Focus on self-improvement

Although wealthy people are frequently voracious readers, their bookcases don’t typically contain many mindless beach novels. The wealthy people recognize the value of continuing their education on their own and pushing themselves to improve in all areas. In reality, the majority of the books stacked by their beds are self-improvement-related. While 85% of the wealthy read two or more self-help books each month, only 11% do so for pleasure, compared to 79% of the poor. And a staggering 94% of the wealthiest read news media, compared to only 11% of the less wealthy.

Never completely retire

The ultra-wealthy undoubtedly have enough money to retire at any time, but the bulk of them continue working, at least in part, frequently well into their 70s. That doesn’t mean they work long hours; in fact, they probably take plenty of vacation time and appreciate having flexible schedules. However, a lot of wealthy people never truly retire. Not because they lack the means to do so, but rather because they adore what they do. Many people have an innate urge to run and expand a business, and this desire rarely goes away. Their total satisfaction is significantly influenced by their employment stability, as well as the sense of fulfilment and purpose , it provides. Working gives them a constant sense of accomplishment and a goal to keep them motivated. Additionally, it keeps the money coming in.

Take time to reflect

Many self-made millionaires dedicate time each day to serious thought. They can reflect on their lives and aspirations, examine their relationships and health, think about their job and financial ambitions, and assess where they are now and where they want to go by taking 30 minutes to themselves in a quiet place. To stay competitive and take into account any future changes, critical thinking time is crucial. This is also a good time to concentrate on developing yourself and thinking things through. Some people choose writing or journaling as a way to assist them generate original solutions and ideas. Just be sure that the time you spend thinking is useful. Don’t squander your brain capacity on self-doubting ruminations or negative thought patterns.

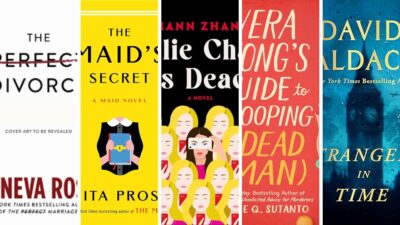

Also Read: 14 Best African Inspired sci-fi and fiction books