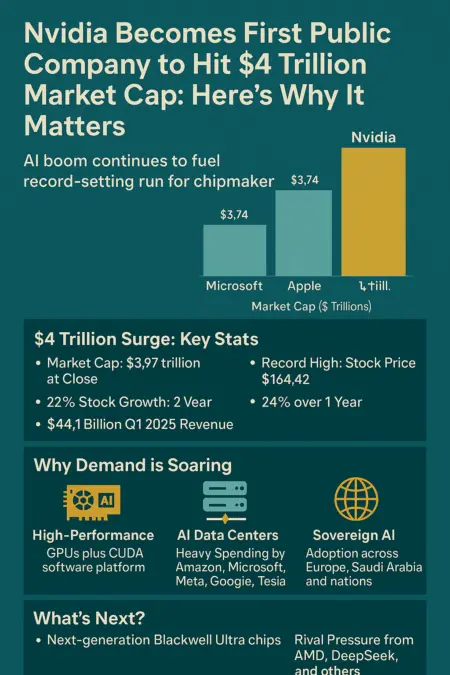

Nvidia has officially made history. On Wednesday, the AI chipmaker briefly became the first publicly traded company to touch a $4 trillion market capitalization, surpassing tech heavyweights Microsoft and Apple—both of which have long battled for the top spot on Wall Street. Though Nvidia closed just shy of the $4 trillion mark at $3.97 trillion, the milestone is a significant indicator of the company’s dominance in the AI revolution.

The $4 Trillion Surge: What Drove It?

Nvidia’s stock rose nearly 2% in a single session, reaching a record-high trading price of $164.42 and closing with a 1.8% gain. Over the last year, its stock has climbed 24%, with a 22% increase year-to-date.

This bullish momentum is largely due to the exploding demand for AI technologies. Nvidia’s high-performance GPUs, modified graphics chips, and its proprietary CUDA software platform are considered essential to training and running AI models, giving it a key competitive edge over rivals like AMD and Intel.

AI Boom Powers Nvidia’s Ascent

The rise of generative AI—ignited by OpenAI’s ChatGPT in 2022—has turned Nvidia’s hardware into the industry’s gold standard. Giants like Amazon, Microsoft, Meta, Google, and Tesla are pouring hundreds of billions of dollars into Nvidia hardware to build AI-enabled data centers and train large-scale language models.

Notably, sovereign AI is also fueling Nvidia’s growth. Countries like Saudi Arabia and several across Europe are building AI infrastructures independent of foreign providers. Nvidia is expected to supply hundreds of thousands of chips to these new sovereign data hubs.

From Doubt to Dominance: A Remarkable Recovery

Earlier this year, Nvidia’s momentum seemed at risk. In January, the company lost $600 million in market cap after Chinese firm DeepSeek unveiled its R-1 model, claiming it was trained using cheaper chips. That revelation raised fears about Nvidia’s expensive processors becoming obsolete—especially as the industry began to shift focus from training AI models to inferencing, or using them.

However, those concerns proved short-lived. The market has since realized that inferencing tasks also demand powerful chips, especially for answering complex, real-time queries. Nvidia’s processors remain the go-to solution for both training and inferencing at scale.

Trade Challenges and Global Tensions

Despite regulatory challenges, Nvidia has kept its momentum. The U.S. ban on chip exports to China, imposed by both the Biden and Trump administrations, caused Nvidia to suffer a $4.5 billion loss last quarter. The company expects this figure to rise to $8 billion in the next quarter. Yet, Wall Street remains confident in its growth potential.

Meanwhile, global trade optimism has helped the broader market rally, with the S&P 500 reaching an all-time high. Nvidia alone now makes up 7.3% of the index, outpacing Apple (7%) and Microsoft (6%).

Financial Performance: Surpassing Expectations

Nvidia’s revenue reflects the scale of its success. In Q1 2025, the company reported $44.1 billion in revenue, marking a 69% year-over-year increase. For Q2, Nvidia projects revenue of $45 billion, give or take 2%. Its price-to-earnings (P/E) ratio currently stands at 32, lower than its 3-year average of 37, suggesting it remains relatively affordable considering its growth.

Rivals on the Horizon?

Though Nvidia dominates the AI chip market, competitors like AMD and Google are attempting to undercut prices and build custom alternatives. Meanwhile, Nvidia’s biggest customers—Amazon, Microsoft, and Alphabet—are under investor pressure to curb their AI spending. Still, no rival has matched the performance or efficiency of Nvidia’s GPUs.

What’s Next? The Blackwell Ultra Chips

Looking ahead, Nvidia is set to launch its next-generation Blackwell Ultra chips, expected to push the envelope in AI training and inference even further. With no direct competitor on the horizon matching its scale and capability, Nvidia’s leadership position appears secure—for now.

📊 Nvidia’s Historic $4 Trillion Moment: A Quick Breakdown

| Metric | Details |

|---|---|

| Market Cap (High) | $4 Trillion (briefly reached) |

| Closing Market Cap | $3.97 Trillion |

| Stock Price (Record High) | $164.42 |

| YTD Stock Growth | 22% |

| 1-Year Stock Growth | 24% |

| Q1 2025 Revenue | $44.1 Billion |

| Expected Q2 Revenue | $45 Billion (+/- 2%) |

| Major Clients | Amazon, Microsoft, Meta, Google |

| Key Product | AI-focused GPUs + CUDA |

| Next Innovation | Blackwell Ultra Chips |

| Share in S&P 500 | 7.3% |

| Rival Pressure | AMD, Google, DeepSeek |

Final Thoughts

Nvidia’s march to a $4 trillion market cap is more than a stock market milestone—it’s a reflection of how AI is reshaping global tech investment, infrastructure, and innovation. As the world increasingly relies on artificial intelligence, Nvidia remains the beating heart of that transformation. With cutting-edge hardware, deep market integration, and strategic foresight, the company is poised to define the future of AI for years to come.

Also Read: Is Using AI for Writing Ethical? Tips for Authors, Bloggers, and Students