The dream of retiring young and enjoying the best years of life free from the grind of a 9 to 5 job is a vision that many of us share. Achieving financial independence early is not just a matter of earning a high income; it’s also about smart financial planning and making informed decisions. In the journey toward this ambitious goal, knowledge is power. That’s where the right books come in. A well-curated reading list can offer invaluable insights into managing, growing, and protecting your wealth. Here are five essential financial books that offer strategies and philosophies to help you retire young. Each book addresses different aspects of finance, providing a comprehensive toolkit for anyone looking to make their early retirement dreams a reality.

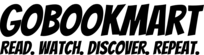

5 Financial Books You Need to Read To Retire Young

1. “Rich Dad Poor Dad” by Robert Kiyosaki

Aspect of Finance: Financial Literacy and Mindset

“Rich Dad Poor Dad” is a groundbreaking book that challenges conventional wisdom about finance. It emphasizes the importance of financial education, teaching readers the difference between assets and liabilities. Kiyosaki’s anecdotes from his own life serve to illustrate how a mindset focused on acquiring assets can lead to wealth.

Implementation: Start by assessing your own finances to distinguish between your assets and liabilities. The key takeaway is to increase your assets (things that put money in your pocket) while minimizing liabilities (things that take money out). This can be as simple as investing in stocks, real estate, or starting a side business from a young age.

2. “The 4-Hour Workweek” by Timothy Ferriss

Aspect of Finance: Passive Income and Lifestyle Design

This book doesn’t just change the way you think about money, but also how you think about work and life. Ferriss introduces the concept of “lifestyle design” and how creating passive income streams can free you from the traditional work schedule, allowing for early retirement.

Implementation: Start by identifying opportunities for automation and outsourcing in your life and work. Create a business or invest in income-generating assets that require minimal ongoing effort. Embrace the digital nomad lifestyle if it suits your career, and don’t be afraid to challenge the status quo of a 9 to 5 job.

3. “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko

Aspect of Finance: Wealth Accumulation Habits

This book reveals that most millionaires live below their means and accumulate wealth through discipline, smart budgeting, and investing. It’s a myth-busting revelation that shows wealth is more often the result of frugality and savvy financial planning than a high income.

Implementation: Adopt a lifestyle that focuses on saving a significant portion of your income and investing wisely. Track your spending, avoid debt, and invest in assets that will grow over time. It’s about making conscious choices to build wealth incrementally from a young age.

4. “Your Money or Your Life” by Vicki Robin and Joe Dominguez

Aspect of Finance: Financial Independence and Life Energy

This book is a guide to transforming your relationship with money and achieving financial independence. It introduces the concept of “life energy” and how to manage money in a way that aligns with your values and life goals.

Implementation: Start by calculating how much of your life energy (time) goes into earning money. Then, work on reducing expenses, paying off debt, and investing in assets that provide a return. The goal is to reach a point where your investments generate enough income to cover your living expenses, allowing you to retire early.

5. “I Will Teach You to Be Rich” by Ramit Sethi

Aspect of Finance: Practical Financial Management

Sethi’s book is a six-week program that covers everything from credit cards and budgeting to investing and big-ticket purchases. It’s filled with actionable advice that can help young adults make smart financial decisions early on.

Implementation: Follow Sethi’s advice on setting up no-fee, high-interest bank accounts, automating your finances to save and invest without thinking about it, and consciously spending on what truly matters to you. This approach helps in building a solid financial foundation that can support early retirement.